Car insurance can be a pain to fork out for. With all the intricate details from location, to age, to profession, they’re out there to sting a pretty penny from us. But just how do you save money on your car insurance? Being the motor trade experts we are, we thought we'd answer those questions for you!

Adding additional drivers can go both ways. Young inexperienced drivers can greatly benefit from having experienced drivers on their insurance policy, but it obviously works the opposite for experienced drivers to add the inexperienced on their plans. Bulking on insurance is a money earner for insurance companies, so their carrot is that typically any standard additional driver will lower your insurance rate per person.

Parking on the drive or in a garage will reduce the cost of your car insurance due to the rates of getting your car stolen are much lower in these circumstances in comparison to parking on the roadside or in a communal/public car park overnight.

We obviously aren’t advocating for you to build an extension on your house to save a little money on your car insurance but it's worth noting that if you do have a garage that can fit a car inside, it may be worth making room to park there or to avoid parking on the roadside in general.

You can achieve a 5% discount on your insurance if you claim to have advanced security on your car, such as; an approved alarm, immobiliser, and tracking device. Of course, most new cars have these but it’s worth getting for peace of mind as well.

You can also find that anti-theft devices can reduce your insurance by quite a bit. The best way to see if you’ll get a discount is to check with the insurer on whether you will get a discount and they may tell you which specific devices or brands can lower your premiums. Car alarms and LoJacks are two of the most popular devices that reduce your premiums.

You may also need to factor in the balance of costs. You may be investing more In the actual alarm rather than saving money on your car insurance, so just keep that in mind.

Often Insurance companies will offer a discount for those who complete an approved defensive driving course. The Defensive Driving course also comes with the benefit that you may be able to reduce the number of points your license, so it’s worth looking into if you’re in such a conundrum. This goes the same way for accident prevention courses as well.

You may have to ask your company about whether these courses will affect your policy, but even then you can shop around with insurers to see what’s best for you. This is particularly beneficial for younger drivers.

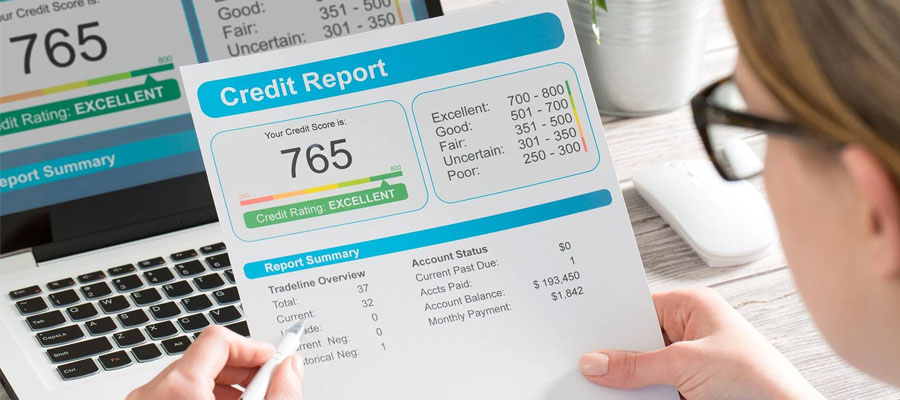

Although it may seem unrelated, your credit rating can say a lot about you to your insurance company. This is because the rating indicates how responsible you are in your personal life and therefore less likely to file a claim. This may be a grey area but in general, your insurance premiums can be slightly dictated by your credit rating so it’s worth looking into, checking, and improving that rating.

Now obviously we’re not telling you to pack your things and go, but it is an important thing to consider with a car. First off, for your sake, you don’t want your car to get stolen or vandalised. Secondly, it’s worth reviewing why your location may increase the cost of your insurance and researching areas that may be more beneficial for you If you are thinking of moving house. Your house contents insurance will likely be cheaper as well if you live in a preferential area. Similarly to keeping your car in a garage, if the insurance company deems your car being safer the cost will come down.

It's worth reviewing your insurance policy on the basis that you may be paying for something that you don’t need. Clearly you don’t want to put yourself at risk so you need to ensure that what you opt-out for is not going to affect you, or at least not by much. If for example, you have a very old car that’s on its last legs, it’s worth considering dropping the collision or comprehensive coverage on the basis that the car would only receive very little in return anyway. In this circumstance, a third party, fire, and theft policy could give you the security you need without breaking the bank.

It’s also worth speculating whether the cover or care that you want can be purchased for a cheaper price elsewhere and bought separately. Add-ons such as; Legal Assistance, Courtesy Car Cover, Personal Accident Cover, Windscreen Cover, and Protected No-Claims Bonus can be found cheaper bought separately. Some risk-takers out there may want to pick and choose exactly what they want. I know I've never damaged my windscreen, but have you?

It doesn’t matter if it’s there to make your car safer or perform better – modifications are not in line with the manufacturers original specification. In the eyes of an insurance company the vehicle is fundamentally changed. If you don't make the insurance company aware of these modifications, you may not be covered. The reason for this is that modified cars can increase the value of the car (sometimes decrease). They may also make the car more likely to be stolen. Modifications could also be deemed as unsafe by the insurance companies making the chance of accident or injury higher.

Now we know this sounds pretentious and not all accidents you’ll have will be at fault of yourself, but you can actively have an impact on your car insurance price if you drive well. Blackbox policies can monitor your driving and reward those who drive carefully. Actively keeping a distance from other drivers, keeping to the speed limit, and generally driving cautiously will put you at an advantage.

These black boxes are officially called telematics which check your speed, how aggressive you accelerate and brake, how cautiously you drive, and also whether you are on the road at dangerous times such as early in the morning.

Obviously, there can be a gain or cost to this. For young drivers, the use of this is a big win since insurance prices are staggeringly high for those who start driving. For those of you who have earnt your no claims and have a relatively low insurance already, you could be at risk of increasing your insurance if you’re both in an accident that you should avoid reporting (e.g. you hit the car into a wall and there’s little damage, any recording of the event could penalise you and inflate your insurance costs) or if it thinks you drive unsafe and erratically.

But with some insurers offering an upfront discount if you take the telematics policy, it’s certainly something to consider if you’re driving a car that’s in a high insurance category.

It’s always worth comparing the insurance rates from time to time on the basis that these premiums change. You may find greater advantages, bonuses, and rewards in a different company a few months or years after your last. Keeping on track with your insurance costs can inevitably lead you to saving the most money possible with your insurance.

It’s also worth trying to haggle with comparison websites so that you can persuade them to drop their prices in accordance to another website or get them to drop lower if you threaten to look elsewhere or take someone else’s offer.

Please be careful of insurance deals that seem too cheap! They often will be for a reason and may miss coverage that other deals do.

By not owning the car you don’t have the commitment of dealing with inflated prices as the car degrades as well as the benefit that a new car will lower your insurance by quite a bit. It’s a good idea to do a lot of research when it comes to finding the car you want to lease since cars fall into groups from 1-50 (1 being the cheapest, 50 being the most expensive). It’s also worth noting that comparing insurance costs three weeks before the policy start date typically gets you the cheapest rates.

If you want to be saving money on your car insurance and you’re thinking of leasing a new hybrid or electric car, here are some of the best cars for their cheapest insurance rates for a 45 year old:

Insurance Group 10 - From £276

Insurance Group 7 – From £322

Insurance Group 11 – From £311

Sign up to our newsletter and find exclusive offers and content.